How is the journey to Product-market fit?

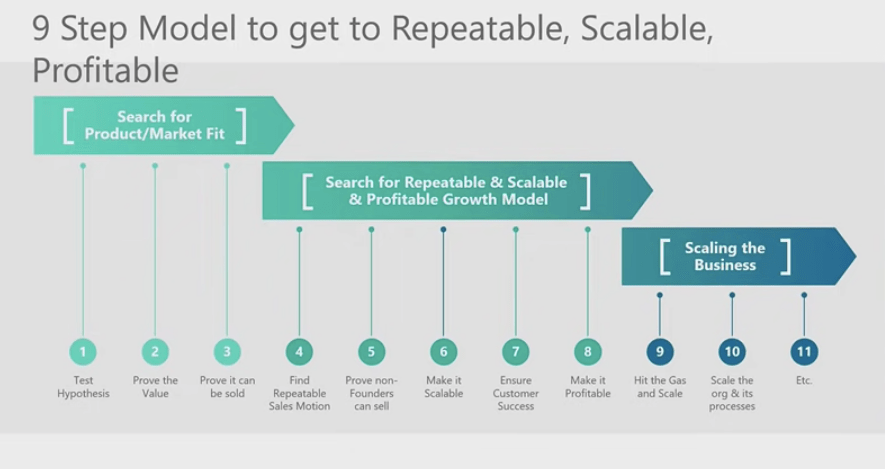

After the very birth a B2B SaaS start-up and before the whole sales motion can be automated by a team of sales folks, in between everything is about product-market fit. It is mostly lead by the founder sometimes with a trailblazing sales person. Below is explained by David Skok.

Does it begin with successful testing of your hypothesis?

“A value hypothesis is an attempt to articulate the key assumption that underlies why a customer is likely to use your product … Identifying a compelling value hypothesis is what I call finding product/market fit. A value hypothesis addresses both the features and business model required to entice a customer to buy your product. Companies often go through many iterations before they find product/market fit, if they ever do.”, Andy Rachleff, co-founder and CEO of automated investment service Wealthfront.

How does successful SaaS start up connects between validating your SaaS idea to the first set of customers?

This framework can be customised to the start-up’s need. While presence of the below elements are expected to make a SaaS business market-product fit when it starts from mare spread-sheet level.

| A | B | C1 | D1 | E | F |

| Problem statement of prospect | what type of solutions they expect in terms of budget/time/ease | SaaS Product features (top 3) | Does it have a network effect (B2B or 2C) | imitability by the vendor or competitor | Ease of Exit |

| “pain” point not supplementary requirement. The same pain that made many other businesses suffer recently. |

Phase 2 spreadsheet columns (10 customers or less plus a battle for sustenance). It comes from the real-time iteration with the users and also with slipped leads.

| C1.1 | D1.1 | G | H | I | J |

| Re-articulate top list of features based on the flow of feedbacks | Micro segments of user groups 1-2-3-4 | Value each client user group/micro-segment is bringing to the table | Ease to measure each feature of segments scale – by the scale created by you- with advise to improve on that space | what can be offered free to trade in dependencies | ARR/MRR |

Early adopters are often the product’s biggest fans (customers 1 to 10x) and are the most willing to provide feedback and criticism about how you can best meet their needs.

If you’re still validating your initial idea and only have a handful of customers, you can reach out to them individually. Just a few calls as early as you can will give you critical insights into your customers’ needs and how your product can be improved to provide a better solution.

What does a doer say?

Jason Lemkin of SaaStr talks about how important it is to collect feedback from your first 10 customers:

[Having 10 unaffiliated customers] means you built something real. Something valued. Most importantly, something you can build on. These 10 customers will give you a roadmap, feedback, and indeed, the path to 1000 more customers—if you listen carefully. Don’t take all their advice, of course, don’t get distracted from the big picture. But, the feedback from these first 10 customers won’t be from outliers. It will be transformatively informative.

How to learn and evolve from the first 100 customers?

Once you have a larger customer base (say, 100 paying customers) you can begin sending out customer surveys to determine whether you’ve reached product-market fit. At its most basic, a survey could consist of only one question: “How would you feel if you could no longer use our product?”

The survey could include just 3 potential answers:

- Very disappointed

- Somewhat disappointed

- Not disappointed

If at least 40% of survey respondents answer that they would be very disappointed to lose your product, you have a strong sign of product-market fit. You can also use the opportunity to ask early customers open-ended questions about your product to gain additional insight.

Interpretations:

- Test and also trust your hypothesis

- Validate from 10x early adapters

- Quickly iterate product, marketing and GTM

- For all of the above stay in constant communication with your initial paid customers.

- Ask about the context (key) to the initial 10x no of customers

- To 100x customers ask their context and quantify additional satisfaction rate (Sean Elias Test) and Net Promoter score.